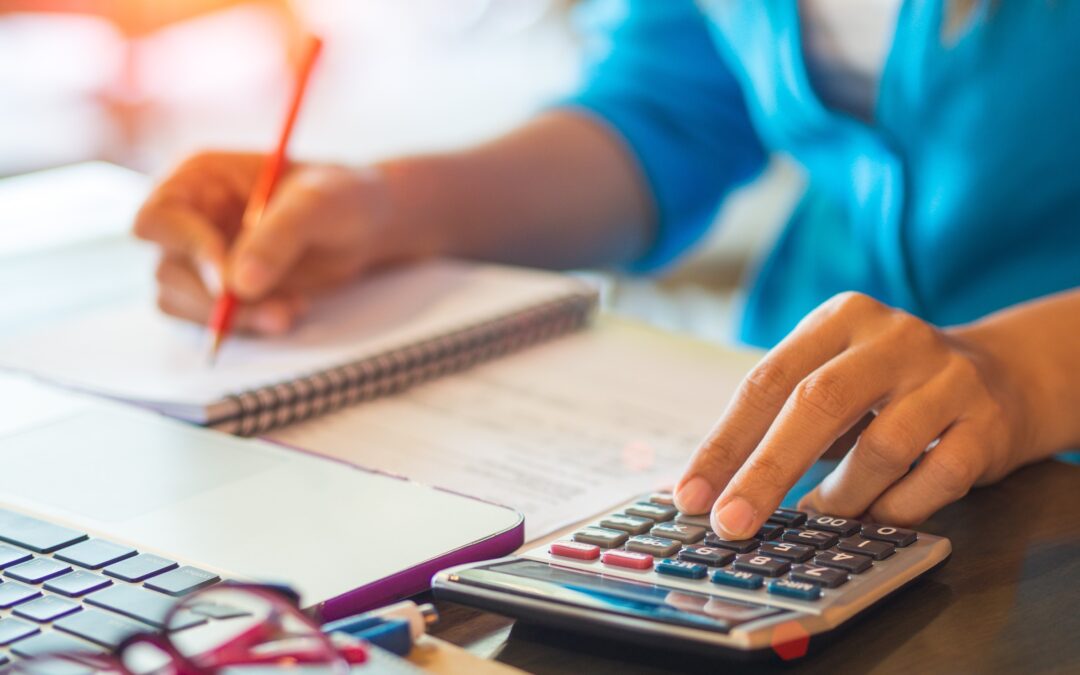

Are you a small business owner? If so, you know how important it is to keep track of your finances. After all, bookkeeping and accounting are essential for any business — big or small.

But if you’re like most small business owners, you probably don’t have the time or resources to hire a full-time bookkeeper or accountant. So what’s a busy entrepreneur to do?

Never fear! We have got a list of 6 tips that will help you stay on top of your bookkeeping and accounting. So, read on and get ready to take your bookkeeping and accounting game up a notch!

Keep track of your income and expenses

Keeping track of your income and expenses is vital for every small business. Knowing where your money is going regularly can help you identify areas where costs can be cut and provide insight into cash flow fluctuations.

Taking the time to properly monitor income and expenses will help you clearly understand the financial position of your small business and develop efficient strategies around managing budgets and cash flow.

So, whether you use software or handheld recordkeeping, it’s vital to regularly take stock of your finances to ensure your small business is on the road to success, today and tomorrow.

Use accounting software

Accounting software is an invaluable asset for small businesses, allowing you to keep track of daily operations and finances efficiently. Software such as Quickbooks can automate tedious tasks like generating invoices, tracking expenses, and generating reports, leaving you with ample time to spend on more pressing business tasks.

Additionally, having the right software in place helps to ensure everything remains organized and data is secure. Investing in accounting software may appear to be a hefty expense initially; however, it will pay off in time saved and peace of mind gained.

Stay on top of your invoices

Staying on top of invoicing is essential for small businesses to ensure proper cash flow management. Sending out invoices promptly as soon as possible is key to getting paid quickly, safeguarding against customers missing payments or delaying them.

Keeping track of your invoicing system can help you make the most effective use of your time, enabling you to focus on other areas of your business.

Keeping clear records and paying attention to when the payments are due, and following up will help you stay on top of your bookkeeping and accounting tasks.

Understand your tax obligations

As a business owner, one of the most important things to understand is your tax obligations. Becoming informed about which taxes you are required to pay and when can help you save a lot of money in the long run.

It pays to invest a little bit of time upfront learning about these obligations, as it can save many headaches come tax time. Furthermore, taking advantage of any potential deductions you may be eligible for and planning how to structure your finances will make filing taxes far easier.

Don’t wait until the last minute – understanding their tax obligations and starting planning now is critical for small business owners hoping to achieve success.

Hire a professional

When it comes to bookkeeping and accounting for your small business, you must hire an experienced professional knowledgeable in the field. Taking shortcuts can be tempting, but incorrect information or misguided strategies can end up costing a significant amount of time and money.

A professional will provide expert guidance to ensure compliance with local and federal regulations, streamline daily processes, and provide accurate financial statements essential to running your business. Investing in proper bookkeeping and accounting will also help with the sustainability of your company.

Keep good records

Good record-keeping is a vital part of accounting and small business bookkeeping services. Keeping detailed records of all transactions can be beneficial, as you never know when you may need to refer back to something in the future.

It could include creating archives of receipts, invoices, contracts, financial statements, and payment histories. Doing this from the start will save time and hassle if an issue arises at a later stage — everything will be easy to locate, meaning decisions can be made quickly and efficiently.

Accurate records also provide peace of mind for business owners and clients alike, which can help build trust over time.

About SMB Strategy Consultants, LLC-

If you’re looking for reliable and efficient bookkeeping services for your business, SMB Strategy Consultants is your one-stop destination. Our mission is to empower you with good data and practical, proactive counsel. Accurate bookkeeping and strategic financial data equip a business owner with a strong foundation to make big decisions. We understand your vision and help you take your business there! Fill out our contact form, call us at 770-284-4313, or visit our website for more information about our services.